Unexpected financial emergencies can happen at any time in the fast-paced society we live in today, sending us into a panic. Whether it’s a medical bill, auto maintenance, or an unexpected vacation expense, these urgent financial requirements can frequently interfere with our carefully constructed budgets. Now, Instant cash loan have come to light as a potential answer in these circumstances, offering quick access to funds with no trouble. However, can they actually meet our pressing financial needs? Let’s investigate this issue and shed some light on the advantages and factors of rapid online loans.

1. Speed and Convenience:

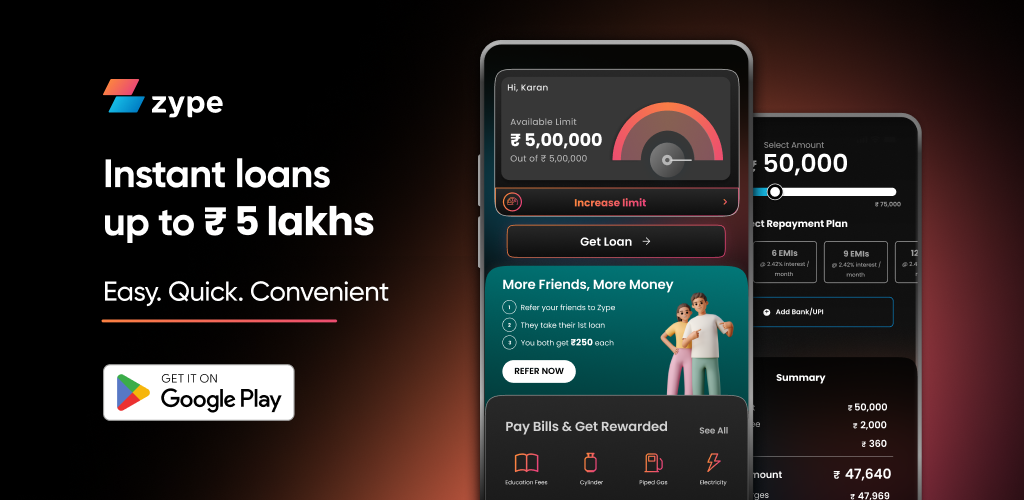

The speed at which they can be completed is one of the most important benefits of rapid internet loans. Online lenders, as opposed to traditional lending organizations, use technology to speed up the loan application and approval processes. You can submit your application from the convenience of your home with just a few clicks. These loans are digital, so there is no need for time-consuming documentation or trips to the bank or lender’s office. Therefore, funds can be distributed swiftly, frequently within 24 hours, offering much-needed aid in dire situations.

2. Accessibility for All:

Financial aid is becoming more easily accessible to more people thanks to instant online loans. Traditional loans frequently demand a strong credit history, collateral, or a drawn-out approval process, which might bar many borrowers in need of money immediately. On the other hand, online lenders frequently have more lenient qualifying requirements, making it simpler for people with bad credit or a short credit history to get a loan. For those dealing with unanticipated financial emergencies, this openness can be a game-changer.

3. Flexibility in Loan Amounts:

Because instant online money loan are available in a range of sizes, applicants can customize the loan amount to suit their needs. Online lenders often provide a variety of loan options, whether you need a modest quantity to cover a tiny bill or a larger sum to cover a significant financial setback. This versatility enables customers to obtain a loan that precisely matches their pressing financial needs, guaranteeing them get the money they need without piling up too much debt.

4. Considerations and Responsible Borrowing:

Instant internet loans can be a lifesaver in times of need, but it’s important to use prudence and borrow responsibly. Given their convenience and timeliness, these loans frequently have higher interest rates than conventional loans. Make sure the interest rates and payback terms are appropriate for your financial situation before accepting an online loan. You should also carefully consider your ability to repay the loan. It’s critical only to borrow what you actually need and to have a reliable repayment strategy in place.

5. Researching and Choosing the Right Lender:

In the realm of Internet loans, careful research is needed to choose a reputable lender. Study the conditions supplied by several online lending sites and loan app India platforms and compare reviews and interest rates. Look for lenders who are authorized and regulated and who have clear lending terms. Working with a trustworthy lender will provide you peace of mind and help you avoid fraud or unfair lending practices.

Conclusion:

When you are faced with pressing financial needs, instant online loans can be a useful tool for bridging the gap between your current situation and the desired level of financial stability. Remember, instant loans India should be used responsibly and repaid on time to avoid future debt. Due to their speed, simplicity, accessibility, and adaptability, these loans are a preferred choice for many people. Prudent borrowing is crucial to prevent debt traps. It’s critical to think through internet loans thoroughly, assess your financial status, and choose a reputable source. By doing this, you can benefit from quick online loans while preserving your long-term financial security.